Specially planned | Domestic food film and television content worthy of attention in 2022

documentary

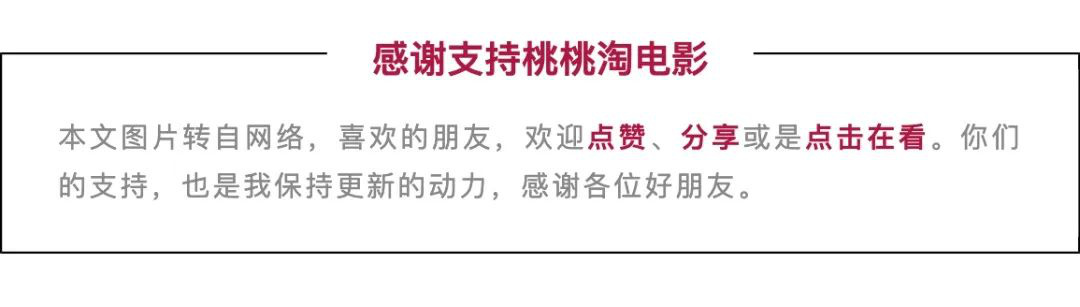

Quest for Guiyang

Premiere time: March 25th.

Broadcasting platforms: Tencent Video and Guizhou Satellite TV.

Producer: Propaganda Department of Guiyang Municipal Committee of CPC, Daolai Media.

The third work of Daolai Media’s "Xunwei" series. "Exploring Guiyang" takes authentic food as a thread, revolves around the three dimensions of "mountain", "water" and "city", and presents the relationship between food and humanity, history and style with a beautiful and pyrotechnic lens. Since the launch of the program, it has caused widespread discussion. Tencent’s video heat value is 6178, and Douban score is 8.3.

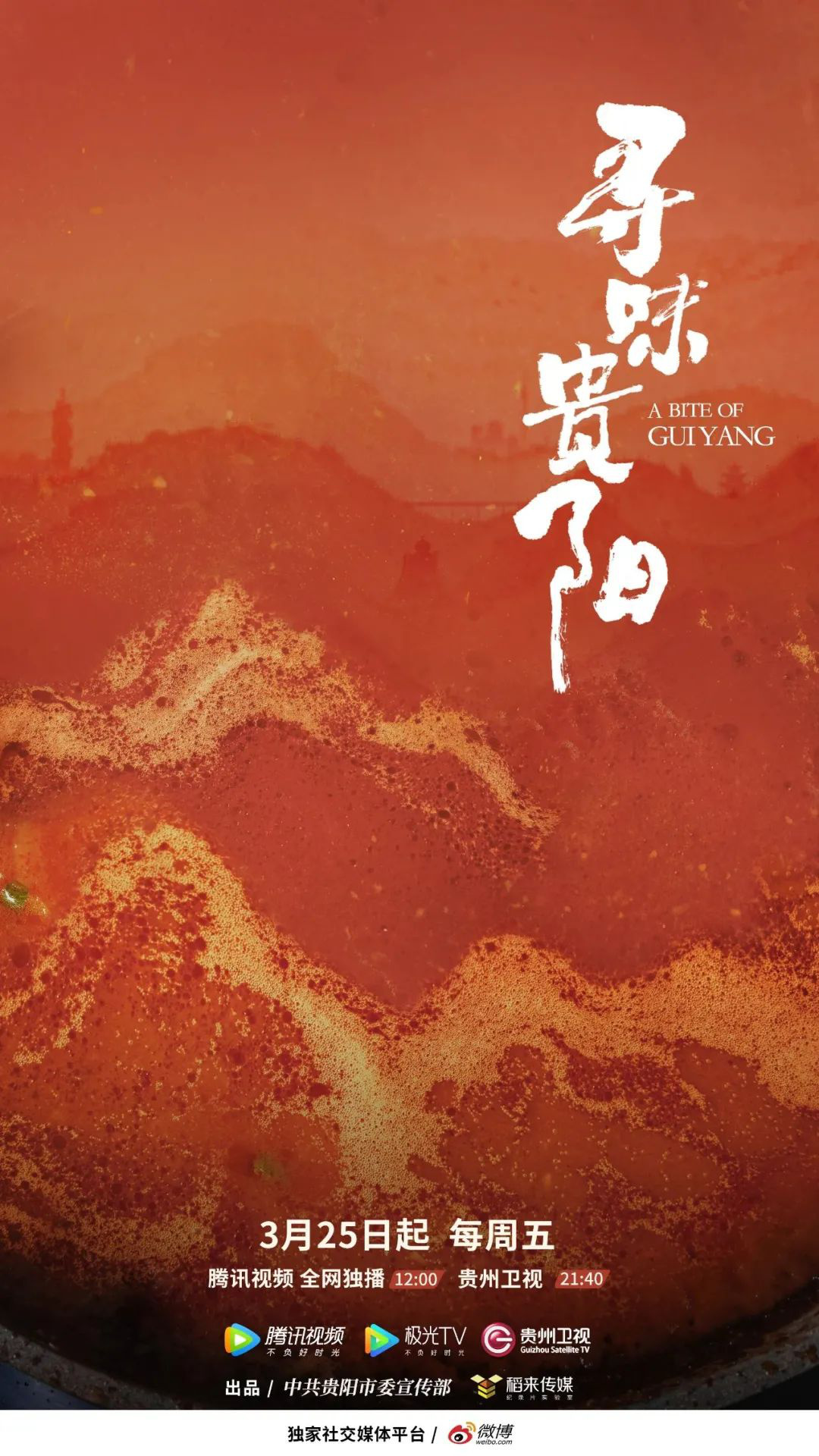

Next meal Jianghu 2

Premiere time: July 28th.

Broadcast platform: iQiyi

Producers: iQiyi, Luming Literature Film, Qujiang Film, Meilin Culture, Fantasy Country.

The series "Going to the Jianghu" is the key IP of the iQiyi food documentary track, and iQiyi’s "Qingchuang Documentary" plan was selected as the first project. The film links "Jianghu" with food and diners, taking the city as the container and vivid characters as the carrier, showing the food culture with regional characteristics. This season, we will continue our previous "Jianghu" temperament and continue to look for the most authentic food with fireworks in eight cities.

Hunan cuisine with proud peppers 2

Premiere time: September 19th.

Broadcasting platforms: Hunan Satellite TV and Mango TV.

Producer: Hunan Satellite TV, Time Huaying

Taking Hunan as the origin, from taste to Taoism, food reflects Hunan’s food culture and customs. According to the 2021 Annual Audience Analysis Report of the State Administration of Radio and Television, Hunan Cuisine of Aojiao ranked second in the first quarter in the annual audience rating of prime-time documentaries. In the second season, we will continue to focus on the tradition of Huxiang cuisine, which is based on time and place, and show the wisdom of chefs in the countryside between cities and the thousands of years of dietary customs in Huxiang.

Jianghu restaurant 3

First broadcast time: November 2.

Broadcast platform: Youku

Producer: Youku

Documentary series of high-reputation food. As its name suggests, the program is full of Jianghu atmosphere and towniness, and tells a generation of "Jianghu chefs" or ordinary or legendary life stories in the streets with young and interesting language. This season continues the exploration of authentic Jianghu cuisine in the first two seasons, focusing on the presentation of "spicy taste". By excavating spicy food hidden in the streets, the unique charm of six spicy food cities is displayed.

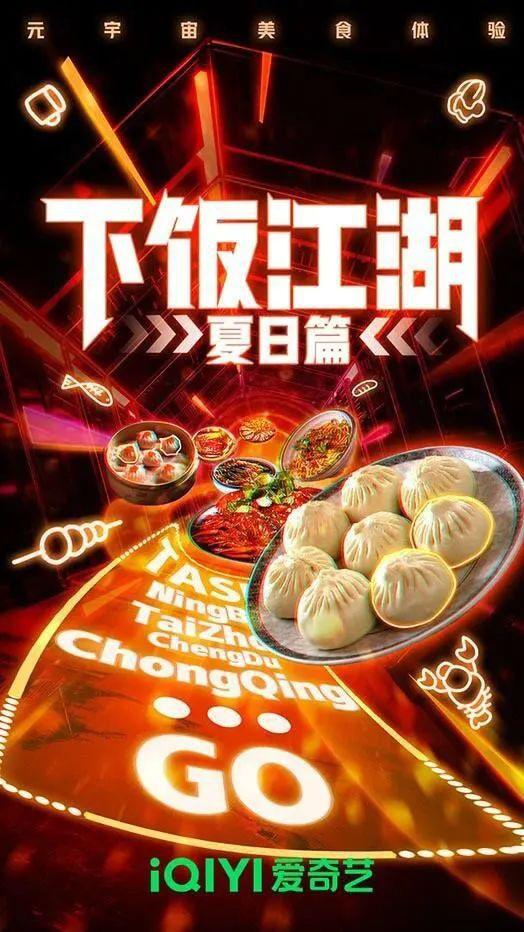

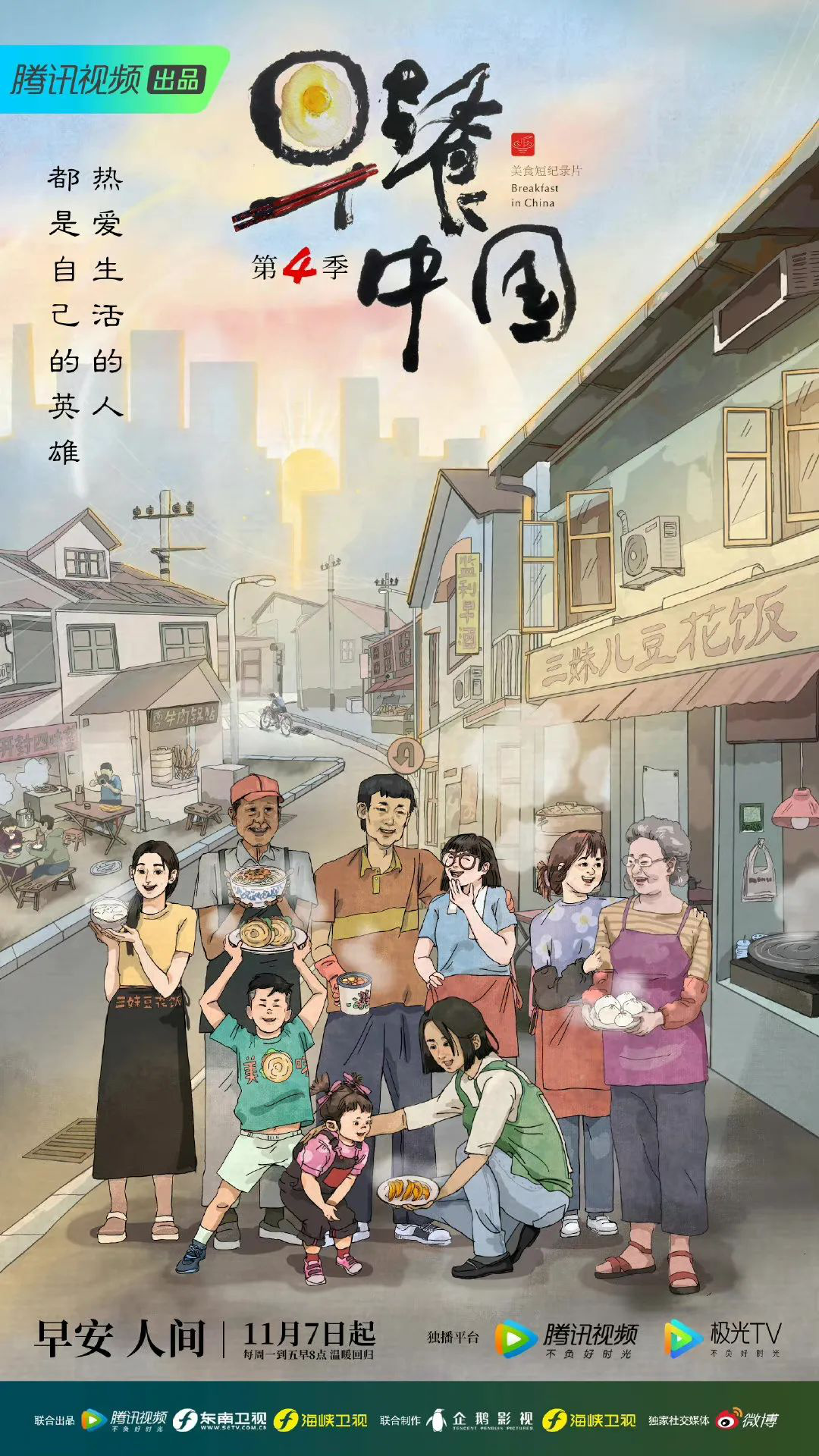

Breakfast China 4

Premiere time: November 7th.

Broadcasting platforms: Tencent Video, Southeast Satellite TV and Strait Satellite TV.

Producers: Tencent Video, Southeast Satellite TV and Strait Satellite TV.

Breakfast China has aired 100 episodes since 2019. The scores of douban in the first three seasons were 8.0, 8.7 and 8.8. This season continues the three characteristics of "fireworks", "fun" and "healing" in the first three seasons, and continues to take root in the streets and lanes of the city, looking for the simple people who like local food and make food, and recording the work and life of the people with the lens, as well as the smiles that bloom because of tasting delicious food.

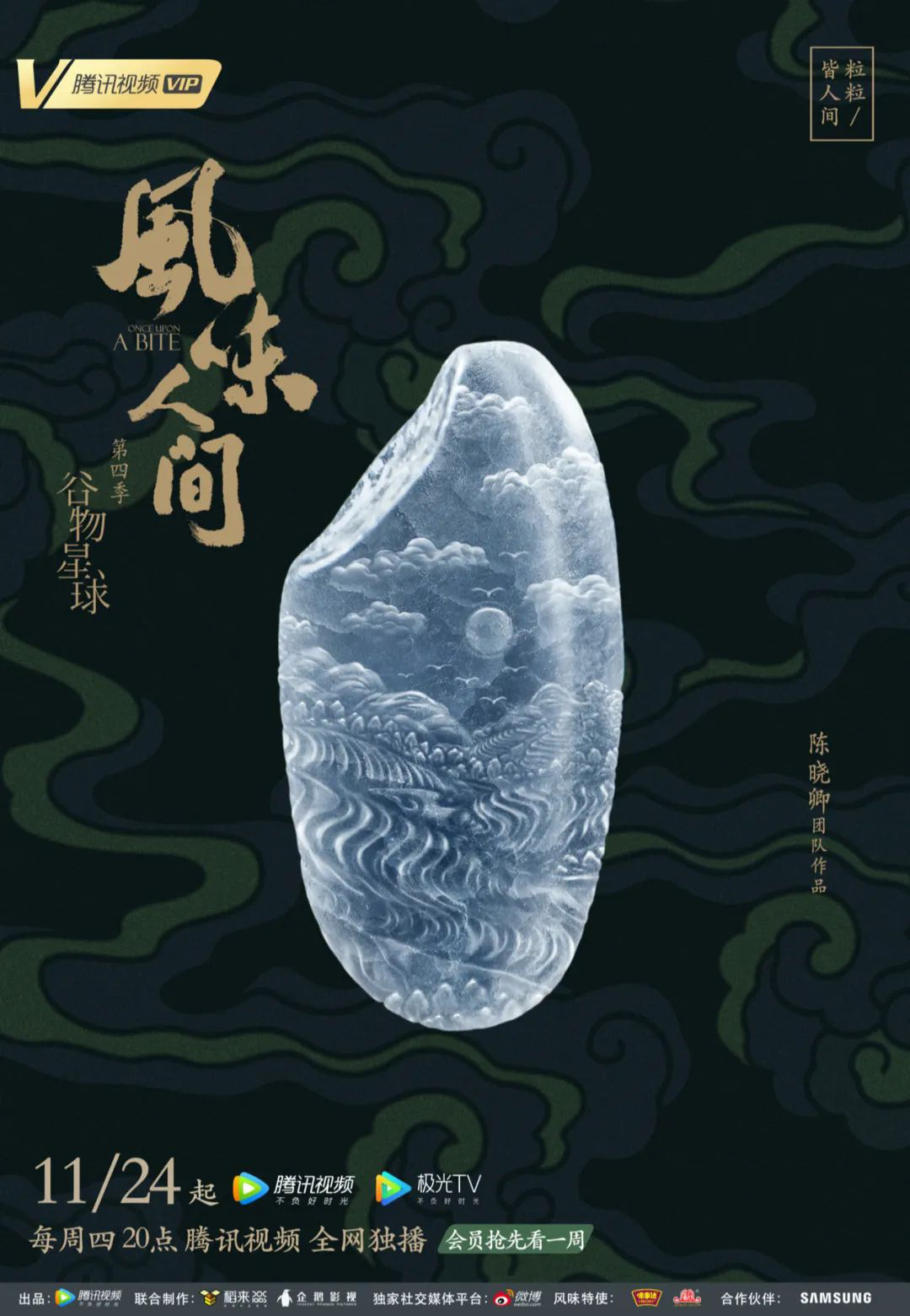

Flavor World 4 Grain Planet

First broadcast time: November 24th.

Broadcast platform: Tencent video

Producer: Daolai Media, Penguin Film and Television.

The well-known food documentary IP "Flavor World" has gained a good reputation in the first three seasons, with douban scores of 9.0, 9.0 and 8.4. The fourth season focuses on cereals, excavating and displaying the map of world food, and reflecting the unique side of the world’s food wisdom and Chinese’s personality from the food.

variety; shows

"punch in! Chihuo Tuan 2

Theme: outdoor food fun experience reality show

Premiere time: July 30th.

Broadcasting platforms: Dragon TV, Mango TV and Mi Gu Video.

Producers: Dragon TV, Happy Media and Chengdu Wenlv.

Starting from food, we can appreciate the eating habits and customs of different cities during our travel. Food combines guest interpretation and game interaction to show the profoundness of Chinese traditional culture. The form of "browsing and eating"+companion attribute makes the program show a natural intimacy, and the douban score is 8.2.

"Eating" for 18,000 Li "

Subject: Real-life reasoning, food exploration reality show

Premiere time: August 5.

Broadcasting platforms: Zhejiang Satellite TV, iQiyi, BesTV and China Blue TV.

Producer: Zhejiang Satellite TV, Fun New Media.

Through the way of star punching experience, on-the-spot story visit and real-life reasoning exploration, the contemporary rural development picture is vividly displayed, so that the audience can feel the positive style of people pursuing a better life while enjoying the delicious food and beautiful scenery. The program Douban scored 8.4.

How about going to your house for dinner 2

Subject: Documentary program of hometown humanistic plot

Premiere time: August 25th.

Broadcast platform: bilibili

Producer: Li Li Li

The program focuses on "Family Banquet, Family and Hometown Stories", and guests invite friends to start a "home-cooked food trip" with the theme of "going home for dinner", recording the friendship of young people, recalling unforgettable growth experiences and telling different forms of family stories. In the second season, apart from bilibili UP, there are also representatives from all walks of life, such as actor King-Tan Yuen, young director Liu Xunzi Mo, policeman Art and Yunnan forest fireman.

Warm hot pot

Subject: Hot pot food emotional reality show

First broadcast time: October 9.

Broadcasting platforms: Beijing Satellite TV and Mi Gu Video.

Producer: Beijing Radio and Television Station

Warm Hot Pot takes hot pot as the carrier to convey the emotional link between people and between people and cities. The program invited Zhang Guoli, Victor Ma and others to form a "Warm Hot Pot Group" to look for people with stories in the city and "save a seat" for them to witness the gathering moment of the clients and convey the true feelings in the world.

A Millennium

Subject: Food Culture Exploration Program

First broadcast time: October 28th.

Broadcast platform: CCTV-3 variety channel

Producer: Art Program Center of Central Radio and Television General Station

Created by the "National Treasure" team, with the framework of "drama+history+food", it deeply excavates various historical delicacies. From the exploration and tasting of dishes and the creation and deduction of a drama, we can feel the profound historical accumulation behind food and appreciate the profoundness of Chinese food culture.

Who is the top chef

Theme: culinary competitive variety.

Premiere time: November 4th.

Broadcast platform: Zhejiang Satellite TV

Producer: Zhejiang Satellite TV and Zhongcheng.

By exploring hometown cuisine, regional cuisine and local ingredients, the hometown shows the differences of characters, and comprehensively examines the players’ abilities of innovation, application, learning and perception in a "multi-dimensional, short-term and strict standard" manner, and restores the signature dishes of the industry benchmark. The 48 contestants have diverse identities, including restaurant managers, star-rated hotel chefs, food bloggers, and even "slash youth" from music, advertising, e-sports and other fields.

serials

On the tip of the tongueHeartbeat

Theme: Youth City

Premiere time: January 13th.

Broadcasting platforms: Zhejiang Satellite TV, Tencent Video, iQiyi, Youku.

Producer: Haohan Entertainment

The story revolves around Jiang Qianfan, a legendary chef in the food industry, and Lin Kesong, a positive energy girl with amazing taste, and tells the challenging road of the two aiming at winning the cooking competition. When the play was broadcast in China, it was launched overseas simultaneously. On the first broadcast day, "Heartbeat on the Tip of the Tongue" was rated 9 points on Mydramalist, an Asian drama rating website.

Shangshi

Theme: costume inspirational food drama

Premiere time: February 22nd.

Broadcast platform: Mango TV

Producers: Mango TV, Entertainment Film and Television, Zhihe Film and Television.

"Story of Yanxi Palace" and "My temples are not red with begonia" were created by the original crew. After three days of broadcasting, the broadcast volume of Skynet broke 200 million. After the drama, the Palace Food Bureau is the background, which shows the pursuit of Chinese food skills by Yao Ziling and others, traces back to the feast fashion and conveys the characteristic flavor. Behind the food, see the history and culture, and see the traditional etiquette.

Treasures and delicacies

Theme: costume food drama

Premiere time: April 7th.

Broadcast platform: bilibili

Producer: Entertainment Film and Television, Bili Bili

"Delicious Story" tells the story of chef Ling Xiaoxiao’s determination to be the best chef in the world since childhood. When she grows up, she enters the palace, meets Prince Zhu Shoukui, and gains love and growth. The drama integrates costume, food and light comedy, and opens the mode of "Dinner Drama". Bilibili has over 200 million broadcasts and 802,000 barrage. Disney+ has purchased the overseas copyright of the play.

short video

Spicy dezi

Fans: 38.562 million in Tik Tok and 9.49 million in Aauto Quicker.

Positioning: Food production based on Northeast home cooking.

The video style is simple and realistic, and the food course is simple and practical, which can be reproduced at home. Spicy Dezi has won the titles of "2019 Shake Incentity Popular Talent" and Youku "Public Ambassador for Helping the Poor and Helping Agriculture".

Mutton cuisine

Fans: 10.151 million in bilibili and 6.827 million in Tik Tok.

Positioning: food production and sharing

The "New Wall Knots Sheep" in the gourmet area is a rhyming maniac in the culinary world. "With the most rigorous real materials and the most flavorful rhyme", the copywriting skills are profound, which also gains a large number of fans. In 2019, 2020 and 2021, it was selected as "Top 100 UP Owners of the Year" in bilibili.

Yanjie gourmet (Chengma)

Fans: 10.769 million (Aauto Quicker) and 8.143 million (Tik Tok)

Positioning: home-cooked food production

Dressed in household clothes, the cooking process of household food is restored with household kitchen utensils, and the engraving is high. The video content is full of human fireworks.

Special planning | Layout expansion type Multi-food film and television content is advanced again

Layout expansion type, diversified food, film and television content, and then advanced

Domestic food film and television content "fragrance" overseas

The development path is very different. A brief analysis of foreign food film and television content

Domestic food film and television content worthy of attention in 2022

Overseas food and television content worthy of attention in 2022

Photo: Douban, program official micro

Please send the submission to the email address:

zongyiweekly@163.com

Please see the micro store for purchase.